Introduction

The accelerated shift to digital, the rise of technology innovations (connected cars, autonomous vehicles, mobility services), and the sheer proliferation of automotive technology companies are driving a significant and disproportional increase in the need for systems interoperability. Data is the lifeblood of these connections, and it must flow freely for the components of the automotive ecosystem to function individually and as a whole, and ultimately meet the needs of the market.

In many other industries, especially nascent ones like app-driven delivery services, interconnectivity is fueled by modern APIs that enable infinite combinations of data packages to transact in real-time. In automotive, while many new technologies are emerging to support innovations like the connected car and mobility solutions, there is still a diversity of legacy back-end systems using technologies like XML and even flat files to exchange data. Despite efforts like STAR to create data standards for common business object exchange in automotive retail, almost all of these systems have unique requirements – whether driven by technical or business rules – and require distinct integration efforts to facilitate data exchanges.

Data and the Automotive Retail Ecosystem

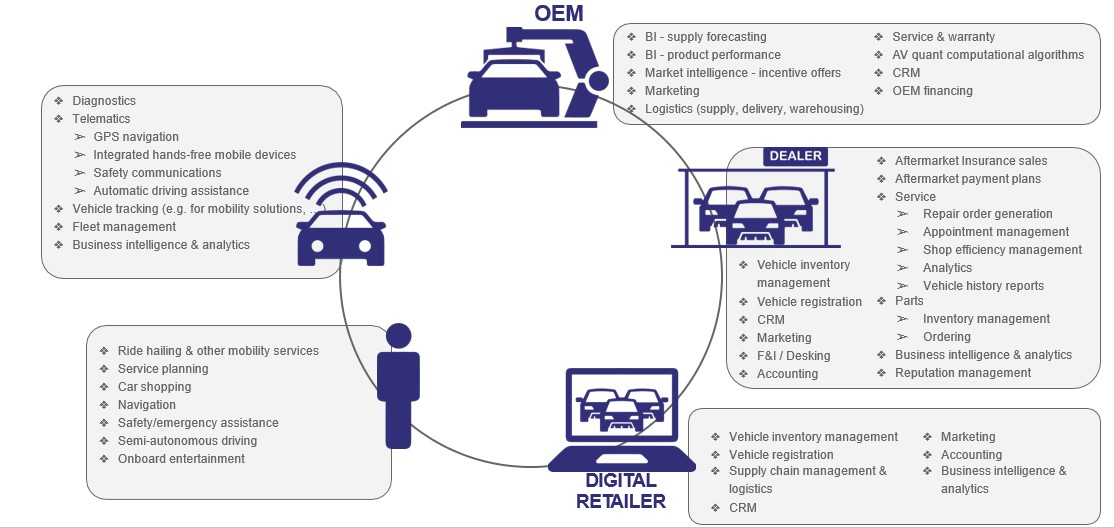

The automotive retail ecosystem comprises the actors who produce, sell, service; and the third parties who support any aspect of producing, selling or servicing new or used cars. In the modern era, data flows between the systems of all of these actors, as well as to the connected car and the consumer applications used by individuals to buy or service cars.

The systems that each of the players in the ecosystem use to run their business or execute their respective roles are limitless, and therefore the data the systems require and produce are infinite. The following illustrates just a few examples of the business use cases that drive the need for systems to generate and consume data across the ecosystem.

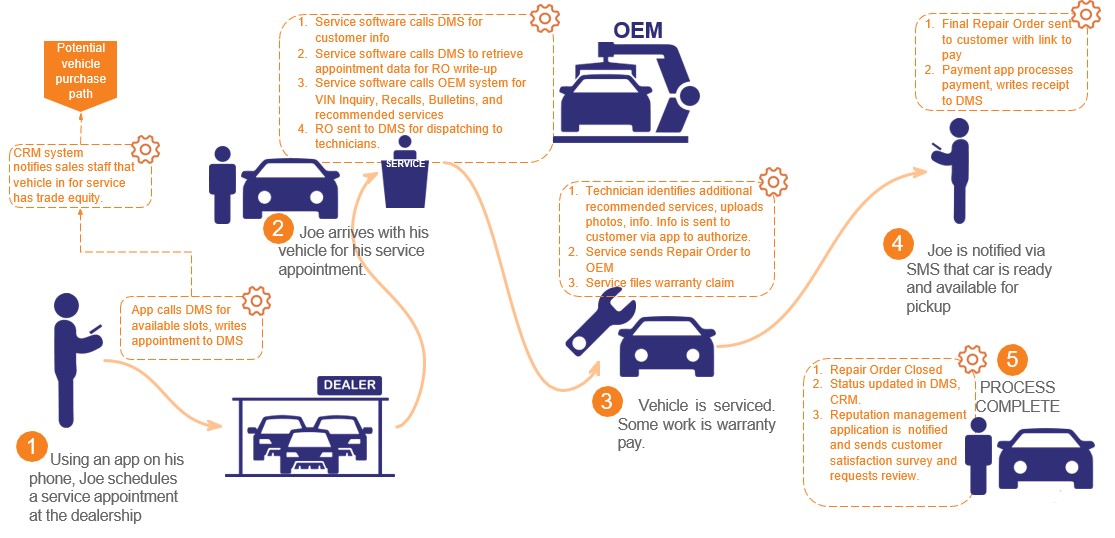

Let’s look more closely at a single customer journey.

There are many integration points that span the entire ecosystem to facilitate everyday automotive transactions.

An Industrial...or Digital Revolution?

McKinsey published a report before Covid-19 that anticipated most of the disruption factors we are experiencing now: vehicle autonomy, connectivity, electrification, shared mobility (ACES), digitization of the market, and the proliferation of new, nimbler innovative tech firms. What wasn’t anticipated was the highly accelerated rates of digitization due to our new stay-at-home culture.

Consumers Say...

In a survey by TrueCar issued during the initial three waves of the pandemic (approximately March, April and May2020), consumers selected aspects of remote retailing including:

- configuring a deal online

- at home test drives

- completing the entire purchase online

- video conferencing

as the top reason they would shop with a particular dealership now. At home test drive showed the most significant uptick between the three waves, increasing in interest 44% between wave 1 and wave 3.

The Disrupters Require MORE System Connectivity

Autonomous Vehicle

While OEMs are considering major new investments in things like quantum computing to support the algorithms required to operate autonomous vehicles, dealerships and repair shops can tap into these systems to enhance predictive-maintenance, or deliver just-in-time marketing messages.

Digital Retailing

The ability for consumers to sit on their couch and surf limitless inventory and offers and execute purchases in the time it formally took them to drive to the dealership means retailers will need to up their game when it comes to accuracy, thoroughness and transparency, not to mention new capabilities like enhanced virtual walkarounds and CRMs that facilitate timely communication 24/7. Where dealers formally received lead info from external sources or uploaded product information to aggregators through manual or daily/weekly processes, they will now need to do so in real-time through reliable systems interconnectivity

Mobility

which broadly encompasses on-demand and alternative transportation like ride-hailing, car sharing and vehicle subscriptions, will require a broad network of fleet vehicles likely sourced from dealers willing to transform their traditional business model. With consumers inherently booking and using vehicles on short notice for short periods, real-time accurate data from dealers’ inventories will be imperative to support the supply and logistics aspects of mobility.

Online Consumer

Despite the typification of Millennials and GenX consumers preferring less personal interaction forms like texting, actually ‘feeling’ a relationship with a business they transact with is potentially more important than ever. Connected processes, such as seamless hand-offs or contextualized engagements based on earlier interactions, are very important to winning their business, and will require that data flows freely across systems all along their buying journey.

The Challenges of Integration

While information gateways like Google’s map APIs seem ubiquitous, exchanging data in automotive isn’t always as easy as registering on a website, entering a credit card, and programming a few simple lines of JSON code…

The Manufacturers (OEM)

At their massive scale, most car manufacturers (OEMs) operate as micro-economies, and the data that runs them is viewed as a coveted asset internally and externally. Every company relies on their data being accurate so that the systems that power business processes run well, but large OEM operations require vast, accurate, real time data to inform short and long term strategies that have very significant consequences. Therefore, most OEMs require that third parties undergo a rigorous certification before integrating to their systems or APIs that will extract data from, or write data to their systems. While OEMs may loosen their grips on certain types of data necessary for automotive digital consumerism, it’s not likely to change overnight. Quality data that adheres to the OEM’s business rules for things like processing warranty claims or fulfilling orders for high cost vehicles will never diminish in importance. The principle that the fewer integrations they manage means lower risk is not likely to change, therefore, they will likely continue to keep tight controls on who integrates to their systems.

Data Security

While the consumer’s data, whether explicit PII or the consumer’s ‘digital shadow’ (which vehicles they viewed, whose sites they interacted with, geolocation information for driving patterns, use of mobility apps, etc.) grows and is housed on multiple platforms, not only must exchanges of the information be authorized, but they must be housed and transported securely. With the value of data continuing to increase, hackers aren’t going away, and will likely continue to evolve their tactics to gain unauthorized access to valuable information. Every integration that an individual auto tech company directly manages multiplies its data security vulnerability, and old ways of exchanging data don’t meet today’s increasing security requirements.

The Dealership Management System (DMS)

Despite the proliferation of software and app solutions that today’s dealer uses to run the business, it's evident from current marketing that DMS providers still prefer that dealers only need to use one system: the DMS. The same is true globally, where the manufacturers may have partial ownership of dealerships and have a heavy influence on the system in use at the store. Few of us consumers can argue with the fact that having a single software vendor is easier than managing multiple systems, apps or contracts, however, the recent decades have proven that smaller, nimbler providers have answered the call for more specialized functionality, like CRM, as well as niche business needs and innovative approaches to serving the evolving market. Will the trend change, and will the DMS regain its foothold as a one-stop shop? Only time will tell, but meanwhile, third party systems and applications continue to emerge and each needs to integrate to the DMS to write or retrieve data (leads, deals, vehicle inventory, service records, etc.) to power its system use cases. And with more and more DMS providers vying to be the dealers system-of-choice, third party vendors still have to integrate to more DMS for otherwise like data exchange use cases to be attractive to the entire market.

Proprietary Systems Definitions

Proprietary business rules and the role of standards- The sheer size of the automotive industry and the need for interoperability has driven a strong need for standards. In automotive, STAR (Standards forTechnology in Automotive Retail)has done an excellent job responding to the requirements and needs of the market to define a set of XML business objects that are broadly used by dealers, manufacturers, business system providers, and other automotive related industry organizations. The success of STAR, or any standards organization that relies on committee style, cross-organization collaboration and decision-making, lies in the broad adoption of the standard. This assumes the market will act for the collective good in all technical implementations, and the consensus organization can keep up with the fast-evolving technologies. Both assumptions have faced challenges thus far in automotive retail.

The Work of Integrations

Wiring point-to-point integrations takes effort that varies depending on the scope of the data being exchanged, the data formats, the business and technical rules of the publishing party, and the quality of the collective integration program. Unclear specifications, overstretched support teams, and inadequate integration testing can all lead to poor quality integrations, or large amounts of unnecessary work on both the publishing and subscribing side of the integration. Many auto technology companies have dedicated resources within their IT teams who work exclusively on integrating their systems to external systems, or on maintaining those integrations in production. All of these efforts deter expensive resources and valuable time away from the important work of internal product development or technical customer support. For companies to continue to innovate and succeed, as the need to integrate across multiple entities increases, the effort to implement the integrations must decrease.

Motive Retail's Commitment

Motive Retail has facilitated over a thousand integrations in automotive retail across the globe. After years of improving the integration process by automating the specification publication and end-to-end testing process on our Motive Integrator Certify platform, and serving as a board member on STAR, Motive Retail has recognized a unique opportunity to address the need for a new standardization solution in automotive. Motive Retail has leveraged its systems interoperability expertise and created a collection of APIs that serve as the Rosetta stone of unique API implementations. The Motive Integrator eXchange (MIX) industry APIs translate the proprietary code bases of unlimited systems that exchange common automotive retail business objects like repair orders, deals, service appointments and many more to a single, JSON REST code base. Now, automotive technology companies can implement a single integration and benefit from secure integrations to multiple backend systems without re-developing, re-contracting, or having to support distinct implementations in production.

For publishing parties who have requirements to maintain direct-only integrations to their proprietary system, such as OEMs who want direct control on data exchanges with their databases, Motive Retail can scale integration programs while improving the net quality of the implementation with its integration automation platform, Motive Integrator Certify. Certify provides a suite of online tools and services that allow the publisher to shift testing off internal IT teams, while providing developers a platform that’s accessible and gives instant, automatic 24/7 feedback. Motive Integrator includes a suite of project management tools to help publishers and subscribers track progress, facilitate dealer activations, and even serve as a communication and program information publication site for integrating partners.

How We're Different

Unlike other services that charge fees to gain access to data from a single proprietary platform, Motive Integrator eXchange (MIX) acts as a multiplier by reducing the integration requirement to a single implementation that unlocks integrations to multiple back-end systems.

Unlike other open API platforms that serve as a marketplace for independent auto-tech companies to publish and market their own API, or to integrate to one system, MIX is a transaction platform that converts data real-time from unique back end systems to a single set of standardized APIs.

Unlike direct integrations to complex systems that require developers to write 10+ calls to get a single business object, MIX simplifies various complex system rules into the most efficient calls to expedite and simplify development for integrating partners.

Unlike in-house integration programs that require subject matter expertise and support on hundreds of unique code bases, business rules and system infrastructures, Motive Integrator Certify presents a repeatable, proven process to test and certify limitless integration implementations, and even provides a platform for continuous testing to accommodate new software releases or revised publisher business rules.

In any situation, Motive Retail does not seek to own and sell data, rather to reduce the cost, effort and barriers to the free flow of authorized data in automotive retail.

All rights reserved. No portion of this publication may be reproduced or transmitted in any form without Motive Retail’s express written permission.

References

Srikant Inampudi, Nicolaas Kramer, Inga Maurer, and Virginia Simmons “As dramatic disruption comes to automotive showrooms, proactive dealers can benefit greatly.” Our Insights. 23 January 2019. McKinsey & Company. https://www.mckinsey.com/industries/automotive-and-assembly/our-insights/as-dramatic-disruption-comes-to-automotive-showrooms-proactive-dealers-can-benefit-greatly

“Vehicle Shopping Now Higher than Pre COVID-19 Levels with Consumers Seeking Custom and Remote Purchasing Solutions.” Globe News Wire, 19 May 2020. Press Release